Universal Life Insurance

What is Universal Life Insurance?

Universal life insurance is a type of permanent life insurance that combines a death benefit with a savings component, which grows on a tax-deferred basis. Policyholders can adjust their premiums and death benefits over time, offering flexibility. The cash value earns interest based on the insurer's portfolio or market rates, and policyholders can borrow against it. Universal life insurance provides lifelong coverage, as long as the premiums are paid, and it offers potential cash accumulation, making it a versatile option for those looking to balance insurance protection with investment growth.

Key features of Universal Life Insurance include:

1. Flexible Premiums: Policyholders can adjust the amount and timing of premium payments.

2. Adjustable Death Benefit: The death benefit can be increased or decreased, depending on the policyholder's needs and underwriting requirements.

3. Cash Value Component: Accumulates cash value over time, earning interest based on market rates or the insurer's portfolio performance.

4. Policy Loans and Withdrawals: Allows borrowing against or withdrawing from the cash value, usually on a tax-deferred basis.

5. Lifelong Coverage: Provides permanent coverage as long as premiums are paid.

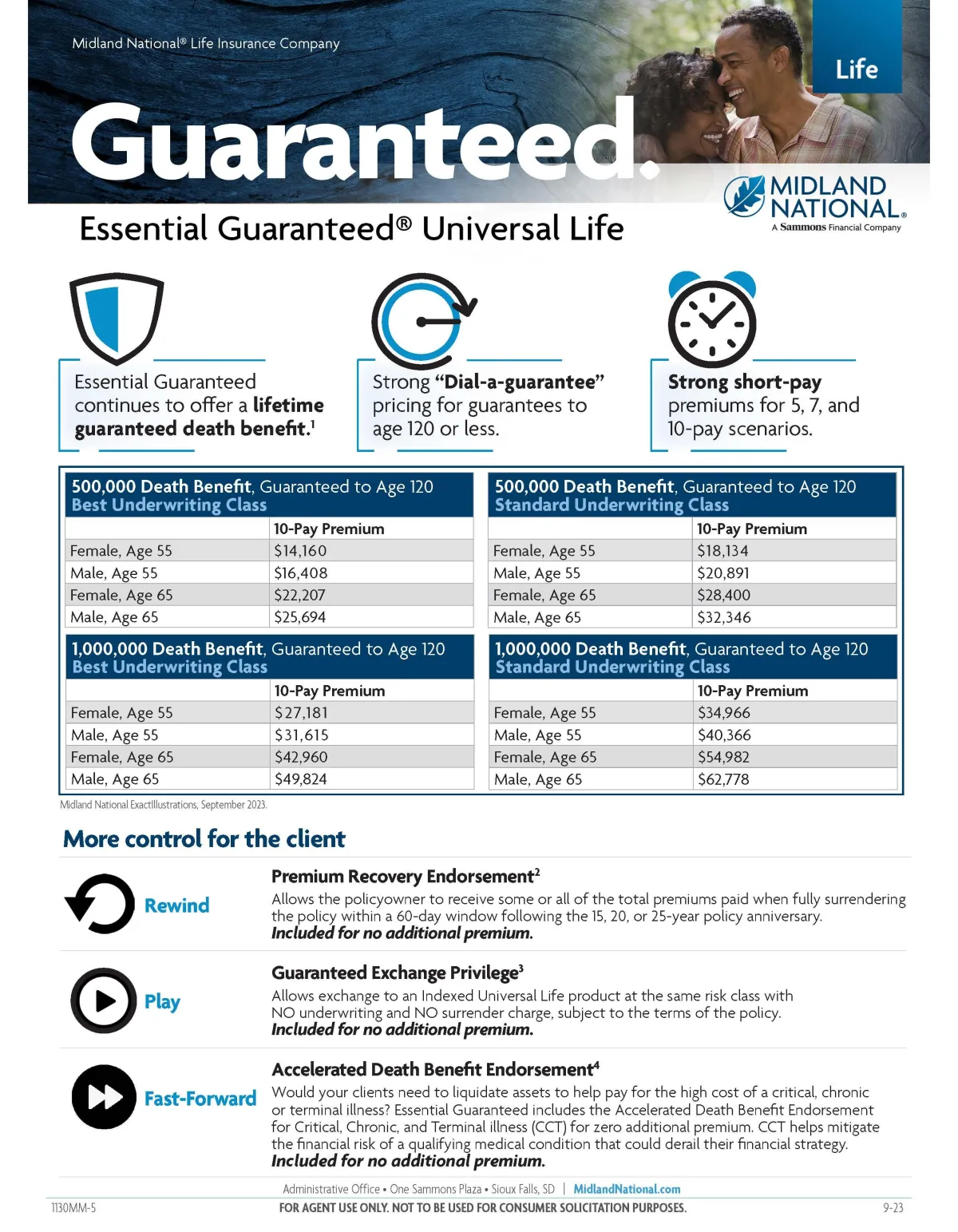

Essential Guaranteed Universal Life Insurance

Lifetime Guaranteed Death Benefit: Offers a lifetime guaranteed death benefit.

Dial-a-Guarantee Pricing: Pricing available for guarantees up to age 120 or less.

Short-Pay Premiums: Strong short-pay premiums for 5, 7, and 10-pay scenarios.

Premium Examples (10-Pay Premium for $500,000 and $1,000,000 Death Benefit):

Best Underwriting Class: $500,000 at age 55: Female $14,160, Male $16,408

$1,000,000 at age 55: Female $27,181, Male $31,615

Standard Underwriting Class: $500,000 at age 55: Female $18,134, Male $20,891

$1,000,000 at age 55: Female $34,966, Male $40,366

Additional Features:

Premium Recovery Endorsement: Option to recover premiums after 15, 20, or 25 years.

Guaranteed Exchange Privilege: Exchange to an Indexed Universal Life product without underwriting.

Accelerated Death Benefit Endorsement: For critical, chronic, or terminal illness at no additional premium.